Wealth Shield: Integrating Commodities for Diversification in Private Portfolios 🛡️

The goal of Private Wealth Management is to preserve and grow capital across economic cycles. Consequently, relying solely on traditional stocks and bonds often exposes wealth to unnecessary risk. Commodities for Diversification offer a compelling solution. They introduce unique, non-correlated returns to a private portfolio. At Crestmont Group, we view strategic allocation to Commodities for Diversification as essential. We help clients build resilience and protect their assets against systemic threats like inflation.

Why Commodities for Diversification is Essential

Diversification is the only “free lunch” in finance. Essentially, it means mixing investments in a portfolio to reduce overall risk. However, traditional assets often move together. When stocks fall, bonds may offer some safety, but they frequently decline as well during periods of high inflation. Commodities for Diversification break this pattern.

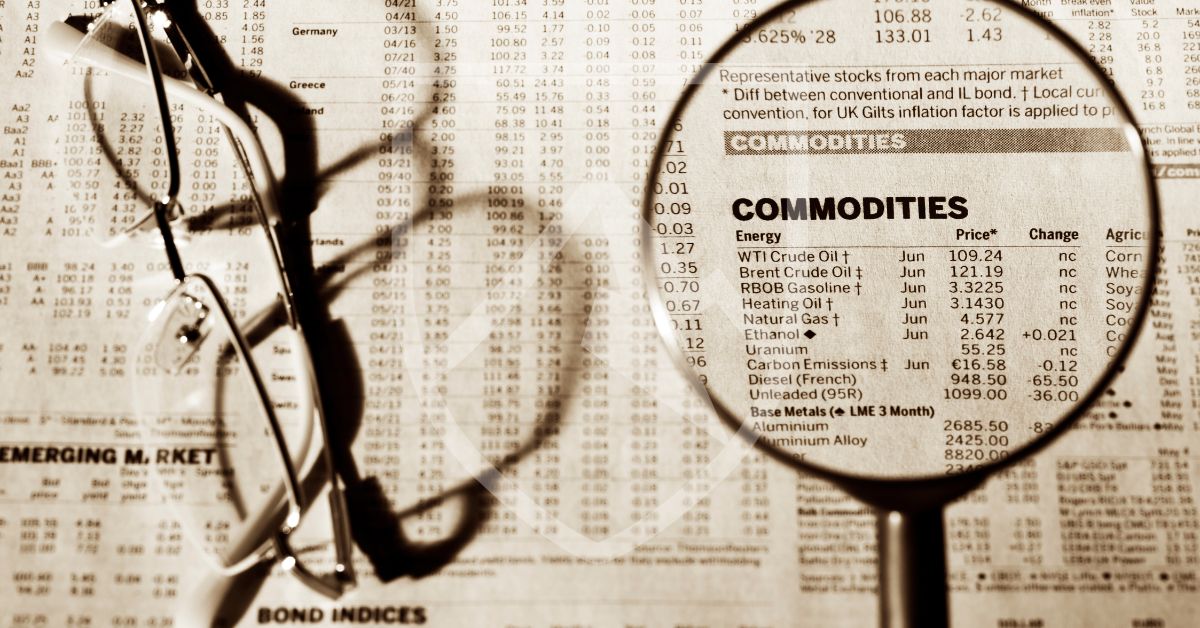

- Non-Correlation: Commodities—like gold, crude oil, and grains—have a low correlation with financial markets. When the stock market declines, commodity prices may stay stable or even rise. This offers a true hedge.

- Inflation Hedge: Commodities are tangible assets. Therefore, their value tends to rise alongside inflation and input costs. This direct link makes them an excellent defense against the erosion of wealth, a key risk we analyze when discussing Inflation’s Impact on Commodity Portfolios.

Ultimately, adding Commodities for Diversification strengthens the portfolio’s foundation. It improves its ability to withstand unexpected economic shocks. You can explore the benefits of non-correlated assets further in financial research from institutions like JP Morgan.

Crestmont’s Strategic Allocation and Risk Management

We actively guide private wealth clients through the integration of Commodities for Diversification. This process requires specialized knowledge and active management, not passive holding.

Firstly, we determine the appropriate allocation percentage. Secondly, we decide how to gain exposure—through financial instruments rather than physical storage. We leverage commodity futures, options, and structured notes. This provides price exposure without the logistical burden. Furthermore, we manage the inherent volatility of commodities through precise hedging. We utilize advanced hedging strategies tailored specifically for these commodity instruments.

Moreover, our expertise in multi-commodity expertise ensures proper diversification within the commodity class itself. We spread risk across energy, agriculture, and metals. This prevents over-reliance on a single volatile sector. Consequently, we transform the raw volatility of commodities into a managed, protective factor within the total investment structure.

Ready to enhance your wealth strategy with non-correlated assets? Contact Crestmont Group today to see how integrating Commodities for Diversification can secure your long-term financial goals.