Turkey Steel Export

The global construction landscape is shifting toward regions that offer both material quality and logistical speed. Consequently, Turkey has emerged as a primary hub for structural steel, ranking as Europe’s largest producer and the seventh largest globally. The ongoing Turkey Steel Export surge supports massive infrastructure projects across the Middle East, Africa, and Europe. However, navigating this market requires a sophisticated understanding of evolving trade barriers and production standards. At Crestmont Group, we help our clients capitalize on this industrial power. We provide the financial and legal structures needed to secure high-grade steel for large-scale development.

Turkey Steel Export Read More »

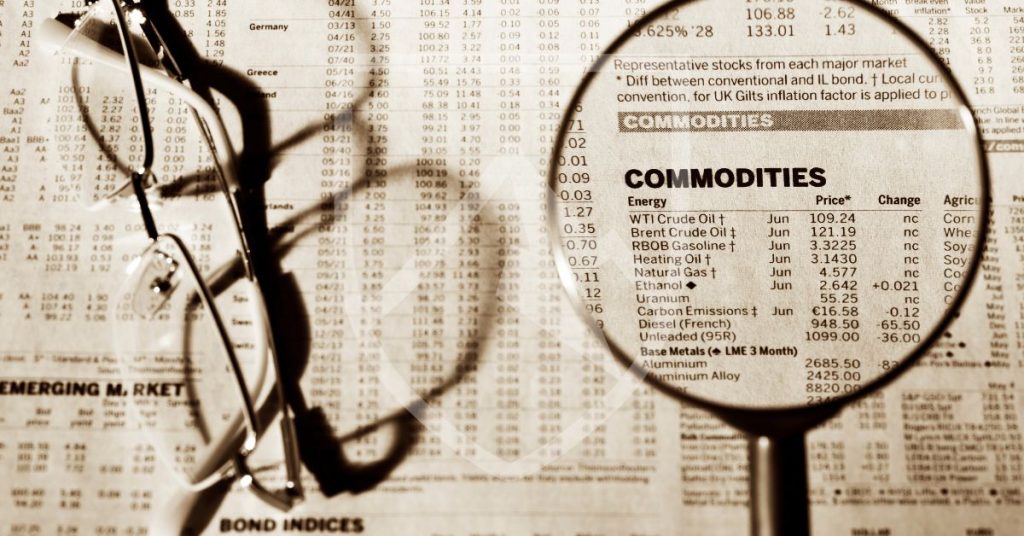

Trading Trading in Commodities